Sectors.

From industry pioneers, to service providers, to investors that drive the sector forward—we've expertly matched hundreds of firms across the life sciences arena with the talent they need.

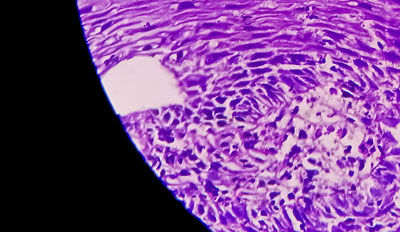

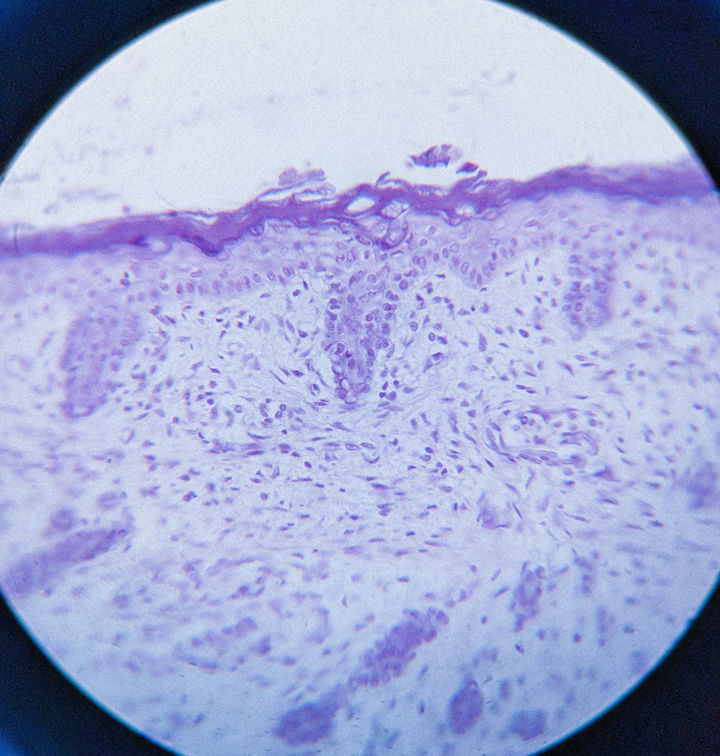

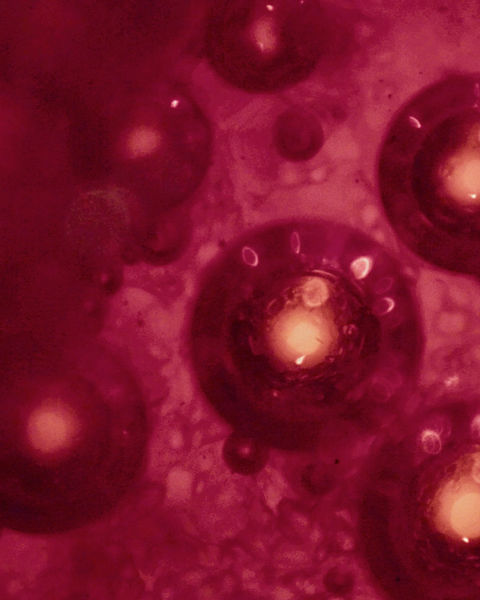

Pharmaceutical

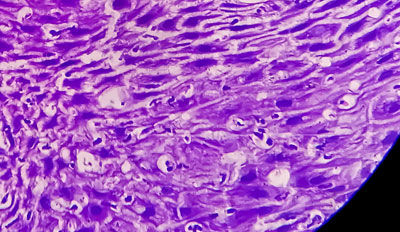

Biotechnology

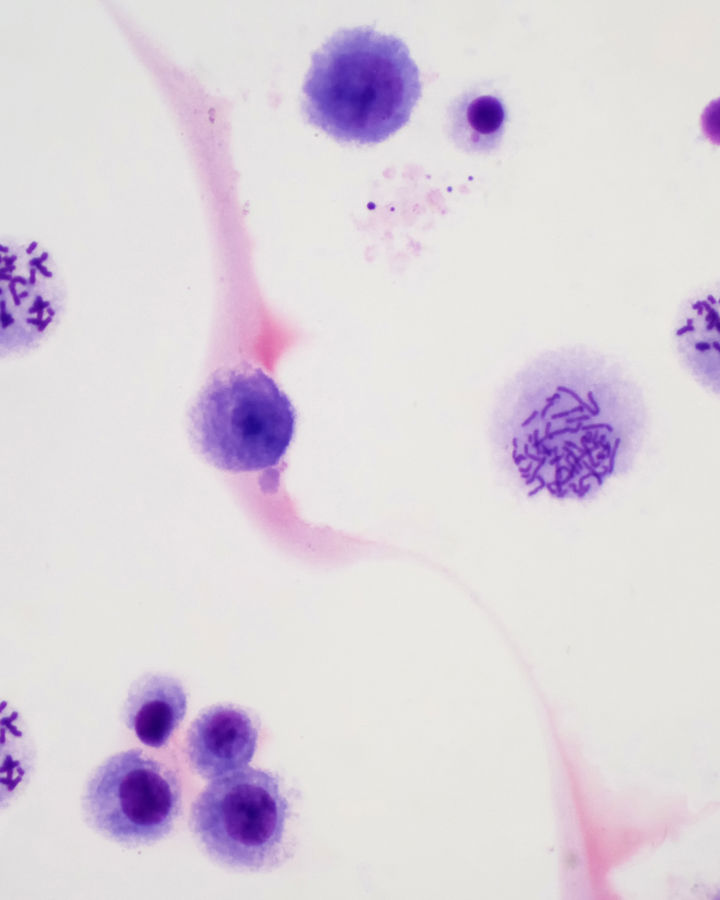

Medical Device

Medtech

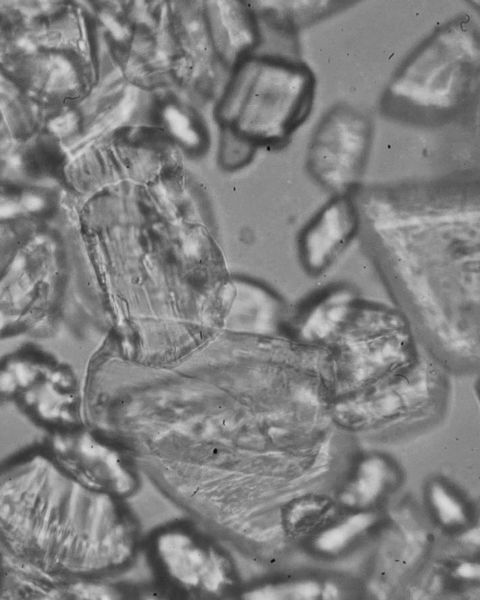

CRO

CDMO

Solutions suite.

We know that the talent acquisition journey begins before a search commences, and extends far beyond a candidate's first day on the job. So we've designed a comprehensive suite of solutions to elevate your entire employer proposition.

They range from crafting a robust employer value proposition and executing targeted recruitment marketing campaigns, to executive search, streamlined onboarding, and post-placement engagement.

Talent

We operate an expertise-driven, tech-enabled approach to talent acquisition.

- Executive Search

- Permanent Hires

- Contingent Workforces

- Process and Offer Management

- Talent Roadmapping

Insight

Designed to prepare your business ahead of a major strategic transformation, such as a scale-up, site opening, trial launch, or relocation.

- Market Intelligence

- Personnel Roadmaps

- Employee Value Proposition (EVP) Formulation

- Employer Brand Strategy

- Talent Strategy Development

Implementation

Support with all that happens post-placement, ensuring the greatest chance at retaining new team members and re-engaging contingent workers and freelancers.

- Regulatory Compliance

- Employer Branding Campaigns

- Workforce Engagement Analysis

- DE&I Measurement and Improvement

- Skills Gap Analysis

- Recruitment Process Audit

- Hiring Readiness Assessment

Appointing the talent you need, faster.

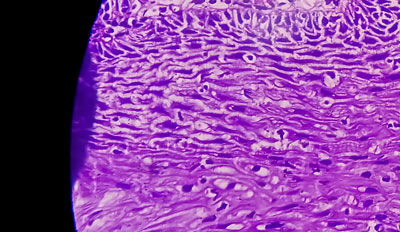

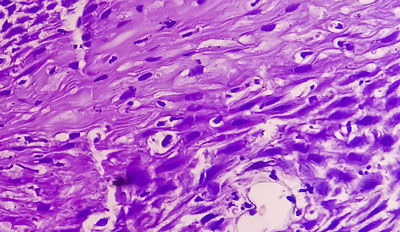

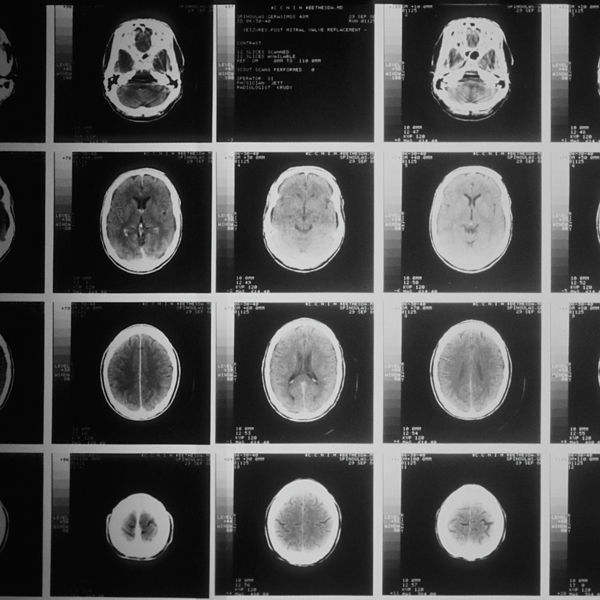

Navigating the world of life sciences is a complex task, and having the right people on your team is critical to your ability to overcome challenges and capitalize on opportunities. The growing presence of skills gaps and the increasing lead time for appointing new hires is creating significant obstacles for companies looking to deliver breakthrough products and solutions.

That's where we come in. Our team of life science staffing experts are devoted to helping leaders in the sector overcome these challenges.

With four decades of expertise and more than 15,000 appointments globally, we've developed a three-tiered approach to efficient and cost-effective hiring, combining traditional talent acquisition support with expert recruitment marketing and implementation solutions.

With you from lab to launch.

From the technically-skilled personnel that drive scientific development through to the leadership to deliver a launch strategy, we have the expertise and strategic positioning to aid your growth from inception through to market success.

Latest insights.

A Career with SEC

Play your part in our success. Join a growing company that invests in your development, offers industry-leading benefits and provides you with the resources to succeed.

More to explore.

Partner with us

Explore our full-service offering to companies in the life science space, and what sets us apart when it comes to talent solutions.

Find a position

We work with boundary-pushing companies across the life sciences industry who are looking for people just like you. Allow us to represent you and identify your next career move.